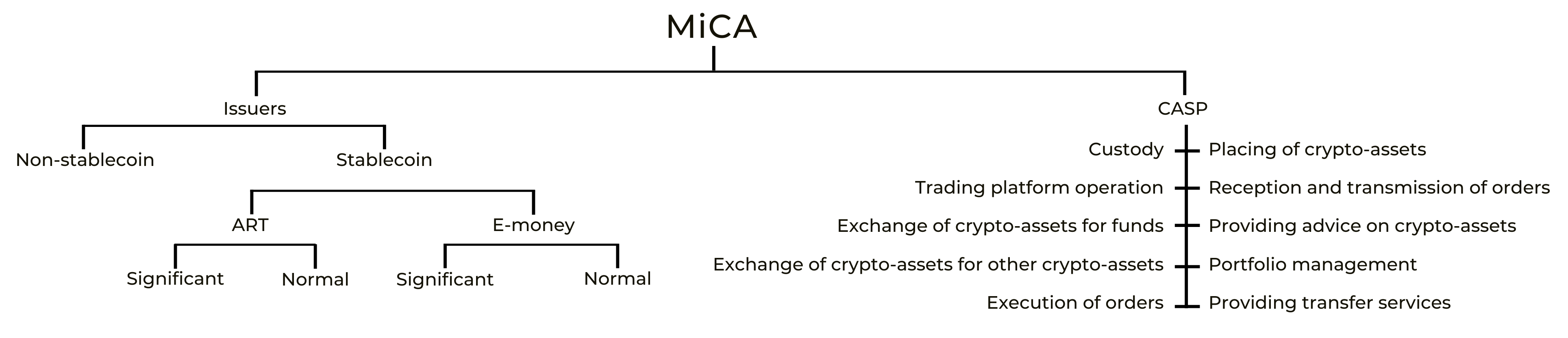

Test The European Markets in Crypto-Assets (MiCA) Regulation has introduced a comprehensive, pan-European regulatory framework for crypto-assets. This includes a passportable Crypto-Asset Service Provider (CASP) license. During a transitional period, national Virtual Asset Service Provider (VASP) authorizations in EU member states may temporarily remain effective, with specific end dates varying by country.

Non-EU National VASP Authorization

Several non-EU countries offer national VASP authorizations covering Crypto Currency Exchange Operator and Crypto Currency Depository Wallet Operator authorizations. The specific type of authorization can vary depending by country. Some jurisdictions may demand separate authorizations for crypto-asset issuance (tokens/coins), Initial Coin Offerings (ICOs), Initial Exchange Offerings (IEOs), and other crypto-asset-related services.

National VASP authorizations can present a viable solution for smaller companies that may find the sophisticated CASP license under MiCA Regulation financially prohibitive. ECOVIS can advice selecting the right national VASP authorization depending on the services planned to be provided and business needs.

Lithuania: EU Hub for Crypto-Asset Service Providers

Lithuania has emerged as a leading European jurisdiction for crypto-asset service providers, building on its established reputation in traditional finance for payment and electronic money institutions. It was one of the first EU countries to offer a transparent and cost-effective VASP (Virtual Asset Service Provider) authorization to international crypto service providers.

By the time the Markets in Crypto-Assets (MiCA) Regulation came into force, over 370 VASP companies had registered in Lithuania. ECOVIS ProventusLaw assisted more than 30 companies getting their VASP authorization.

Key Players in Lithuania’s Crypto Landscape

In 2020, Binance, the world’s largest crypto exchange, secured its Lithuanian VASP authorization. ECOVIS ProventusLaw provided comprehensive support to Binance, including Lithuanian company incorporation, VASP authorization, HR, and compliance.

More recently, in May 2024, Robinhood Europe, UAB, a subsidiary of the US-listed broker Robinhood Markets, Inc. (NASDAQ: HOOD), was granted the first Lithuanian CASP license under the new MiCA Regulation. This license is EU passportable, enabling Robinhood to offer crypto-related services across the entire European Union and European Economic Area (EU/EEA). ECOVIS ProventusLaw has played important role in supporting Robinhood’s crypto operations in Europe since 2023, when Robinhood Europe, UAB was initially incorporated and registered as a VASP in Lithuania. The new EU passportable CASP license replaces the previous national VASP registration, significantly extending Robinhood’s reach across the EU without requiring additional licensing in other EU jurisdictions.

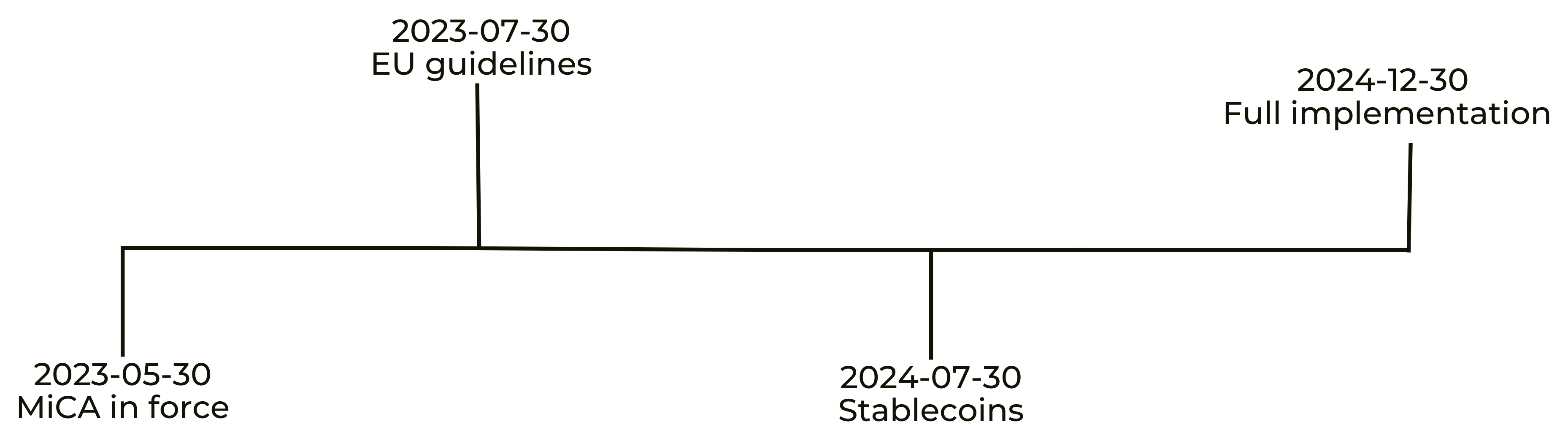

MiCA Implementation Roadmap

Newsletter Subscription

Newsletter Subscription